Al Rostamani Balance Check – Complete Guide to Check Your Balance

Financial services that are digital play

Financial services that are digital play

The ability to manage your monthly

The management of utility bills is

Telecommunications are an important part of

Etisalat offers special data bundles to

our money efficiently. When you’re paying

Digital payment systems are an integral

Salary verification is an essential aspect

It is a common problem for

Gratuity is among the most important

Transparency of salary is one of

The best way to manage your

Financial services that are digital play a crucial function in the everyday lives of workers and residents within the UAE. A lot of people depend on financial providers for their salary processing, remittances, prepay services, as well as other important transactions. This is why tracking the available funds is crucial to avoid delays, rejected transactions or confusion. This comprehensive guide will explain everything you should know about a balance check at the rostamani, including the way in which the balance system operates with the various options, step-by-step instructions, updates as well as security procedures and the right time to reach support. The aim is to provide accurate and clear information to help users control their money with confidence. Understanding Al Rostamani and Its Financial Services Al Rostamani Group is an established company in the UAE that operates across a variety of industries, including financial services exchange solutions, as well as business support. Through its financial services it helps many clients manage their payment in balances, transactions, and balances frequently. The balance linked to Al Rostamani services represents the funds that are currently available for use. The balance can be linked to pay card, prepay accounts or even service-specific wallets, based on the type of product used. Knowing how this balance works is crucial for a smooth financial plan. How Al Rostamani Balance Check Works The process of Al Rostamani Balance Check is made to be easy and easy to use. If a user initiates an inquiry about balances it retrieves the most current data following the accounting of complete transactions, deductions or credits. Most of the time the balances are updated in close to real-time. This lets users make educated decisions prior to transfer payments, payments or withdrawals. Conducting a regular balance check can help users avoid unexpected costs and manage their finances more efficiently. Available Methods to Check Al Rostamani Balance There are a variety of ways that users can monitor their balance depending on the type of service and the method of access. Each method is created to be safe and easy. Read Also: RPay Balance Enquir Online or Digital Platform Access A large number of customers have their balances checked using official online platforms for service or account management. After login the balance is typically displayed on the dashboard that is used for account management. SMS or System Notifications Certain services offer balance updates by SMS or automated alerts following transactions. These notifications help users remain informed, without having to sign in. Customer Service Support If access to digital information is not available or unclear, support will assist users to verify their balance following the identity verification. Step-by-Step Al Rostamani Balance Check Process While the steps involved may differ slightly based on the specific service however the overall process is simple: Access on the authentic Al Rostamani service platform or channel. Log in or verify your identity if required Go to the balance or summary section of your account. Check the balance available shown on the screen This technique allows speedy access and avoids unnecessary problems. A lot of users choose this method for routine inspections. Common Reasons Users Check Their Balance Checking their balances can be done for a variety of reasons. Some are looking to confirm their credit on their salary, while others look over their balance prior to making a transfer or payment. The balance check is typical after deductions, service charges or transactions that have occurred recently. Regular balance monitoring can help users to keep a close eye on their finances. It also reduces the possibility of declining or delayed transactions. Balance Update Timing Explained One of the major benefits of financial systems that are digital is the ability to update balances quickly. However, update speeds can depend on the type of transaction. Transaction Type Balance Update Time Posting of salary or credit Usually the same day Service payment Instant or near-instant Refunds or adjustments It could take a while Failure of a transaction Balance remains the same Understanding these timelines will help users avoid unnecessary anxiety when making checks on balances. Troubleshooting Balance Display Issues Sometimes, users might be able to notice that their balance does not seem to be in the most recent version. This usually happens caused by system delays, connectivity issues, or the processing of a transaction that is pending. The platform can be refreshed by leaving and then logging back in or waiting for a brief period typically will resolve the issue. If the balance appears to be in error, then contacting support is suggested to get clarification. Doing a second balance check after a period of time generally reflects the correct balance. Security Tips While Checking Your Balance The security of financial information is vitally important. It is essential to follow the most basic security rules when looking at balance information. Do not use Wi-Fi networks in public or unsecure locations. You can access balance data only via official channels Never give the login credentials or verification codes Enable all security or authentication features. Log out when you have finished using devices that are shared or public These steps secure accounts from unauthorized access. Why Accurate Balance Information Matters The accurate balance information allows users to plan their payments as well as manage expenses and prevent failed transactions. It also assists in identifying any unexpected mistakes or deductions in a timely manner, allowing swift corrective actions. This is why knowing the proper method for performing a balance check rostamani is crucial for those who use these services often. Difference Between Balance Check and Transaction History Transaction history and balance checking are inextricably linked but have different uses. The balance check displays the available balance at a certain point. It can answer the question of the amount available today. The history of transactions, on other hand, offers an in-depth record of previous activities, such as credits, deductions, as well as service charges. Examining both gives users an accurate picture of the activity of their accounts. Tips to

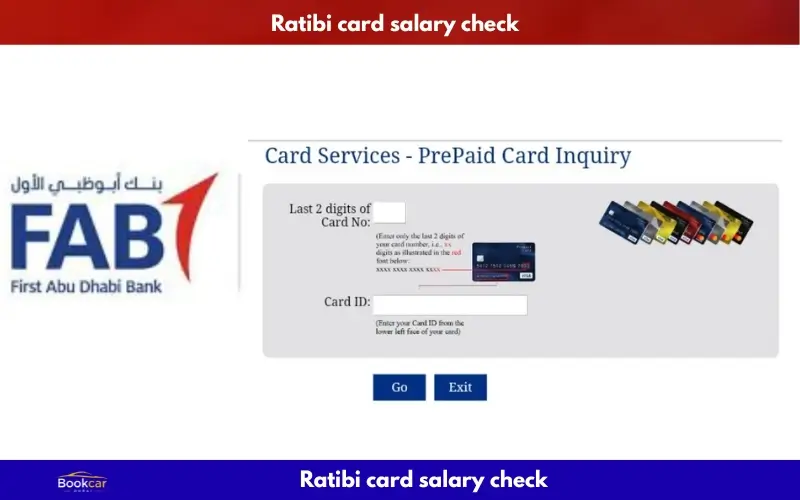

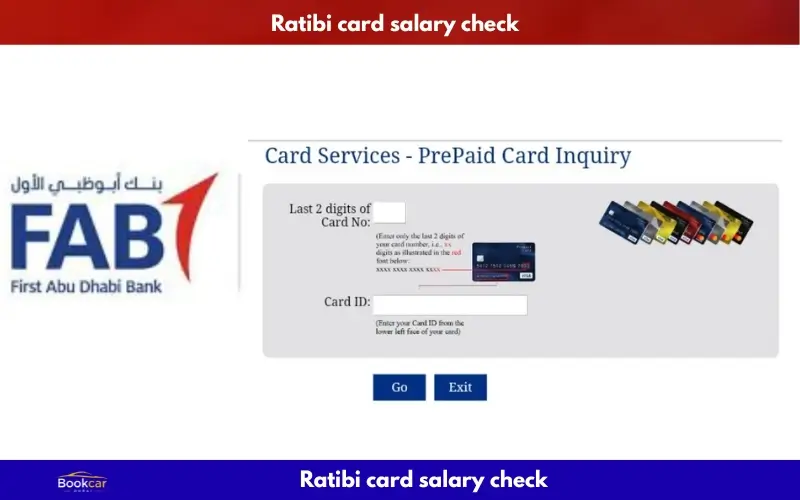

The ability to manage your monthly income efficiently is vital, especially for those who depend on pre-paid salary cards rather than conventional bank accounts. The Ratibi card salary check process assists workers throughout the UAE verify salary deposits to track spending and avoid any unnecessary ATM or merchant-related issues. This guide is intended for employees, laborers and businesses using the Ratibi payroll system, who require accurate, precise and practical data. Ratibi Cards are frequently employed by businesses that are registered under the UAE Wage Protection System (WPS). These cards provide a secure and easy way to pay salary without having to open a bank account. Understanding the way that salary crediting works and how to access the funds, and what options are offered can help you save time and avoid confusion. Ratibi Check Balance and Salary Verification Methods The process of checking your salary balance is among the most important things for cardholders. Ratibi cardholders have a variety of authentic ratibi check balance and safe methods to verify the credit on their salary and the remaining balance. They have been designed so that they are available even to those who do not have phones or internet access. ATM Balance Inquiry Visit any ATM of ADCB across the UAE to verify your balance. Insert your card, type in your PIN, then choose an option to inquire about your balance. The screen will show your current balance instantly. SMS and Phone Banking Some employers offer SMS-based alerts to send salary credit notifications. Furthermore, ADCB phone banking support will assist ratibi balance enquiry cardholders with balance-related issues following identity verification. Salary Credit Timing The majority of salaries are credited within 24 – 48 hours after the employer has processed the payroll via WPS. Weekends and holidays can cause delays in updates. What Is a Ratibi Card and Who Can Use It? A Ratibi card can be described as a pre-paid payroll card that is issued from Abu Dhabi Commercial Bank (ADCB). It’s specially designed for those who don’t have traditional bank accounts, but require a secure option to get their earnings. Eligible Users Private sector employees Domestic workers Construction and labor personnel Small business employees covered under WPS Key Benefits It is not necessary to create an account at a bank Deposits for salary security Simple ATM withdrawals Accepted in major retail outlets This system helps to ensure the financial inclusion of all employees and guarantees the transparency of employers and employees. Salary Withdrawal Options in the UAE When your paycheck is paid after which you are able to withdraw cash or use your card directly to make purchases. Understanding the channels for withdrawals can help you avoid additional charges. ATM Cash Withdrawals Ratibi card can be utilized at ADCB Ratibi card salary check ATMs as well as select partner machines. The use of ATMs that are not network-connected could cause additional fees. Point-of-Sale (POS) Payments The card can be used at pharmacies, grocery stores and malls, as well as fuel stations as well as restaurants throughout the UAE everywhere card cards are accepted. Daily Withdrawal Limits There is an annual limit for cash withdrawals that is set by the bank that issued them. This limit helps protect users from overspending and fraud. Fees and Charges You Should Know Although Ratibi cards are affordable, some services can come with fees. Be aware of these charges to help to manage your income effectively. Service Type Approximate Charge Checking balance at ADCB ATM Free ATM withdrawal of cash at ADCB ATM Minimal or free Refund at a different ATMs at the bank ATM Small fee Replacement of a card Applicable fee PIN reset Usually, there is no cost Charges can vary based on the terms of agreements between employers and bank policies. Common Issues and How to Solve Them Certain cardholders are faced with issues due to their salary credit or card use. The majority of problems can be addressed swiftly if you follow the correct steps. Salary Not Credited Check with your employer to confirm the date for payroll. Verify if WPS submittance was successful Be patient during processing times on holidays. ATM Card Not Working Verify that you have entered the correct PIN The expiration date for your check card Go to an ADCB branch to get assistance Lost or Stolen Card Make a report immediately to ADCB customer service, who will remove the card, and ask for the replacement. Employer Responsibilities Under WPS Employers play a crucial function in ensuring timely payment. As part of the Wage Protection System, companies have to submit accurate data on their payroll and transfer wages on time. Employer Obligations Processing of your salary on time The correct employee details The compliance in accordance with UAE labor laws Failure to adhere could result in fines and delayed payments to employees. Security Tips for Cardholders It is vital to safeguard your earnings. Implementing basic security measures will help you avoid fraud and insecure access. Don’t share your PIN with anyone. Avoid using unfamiliar ATMs Report suspicious transactions immediately Make sure contact information is up-to-date These simple habits ensure your funds remain safe. Advantages of Using Ratibi Cards Over Cash Payments Moving between cash and Ratibi Payroll cards that are prepaid offers many benefits to employees and employers which makes salary distribution more secure and efficient. Transparency Every salary transaction is digitally recorded to ensure transparent and traceable payments. This decreases the risk of disputes and errors between employees and employers. Convenience Employees have access to their funds anytime, without being confined by the hours of work. They can cash out purchase items, withdraw cash, or pay for bills whenever they want, offering flexibility and simplicity. Safety Utilizing Ratibi cards greatly reduces risks of handling cash including theft and loss. Digital transactions are safer and safeguard both employers and employees from financial disasters. Benefit Description Transparency Digital records ensure that all pay stubs are traceable which reduces dispute Convenience The ability to access funds at any time

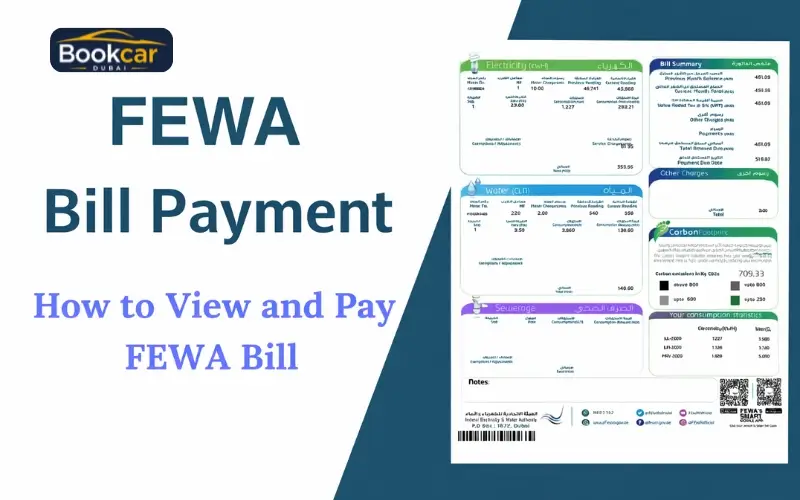

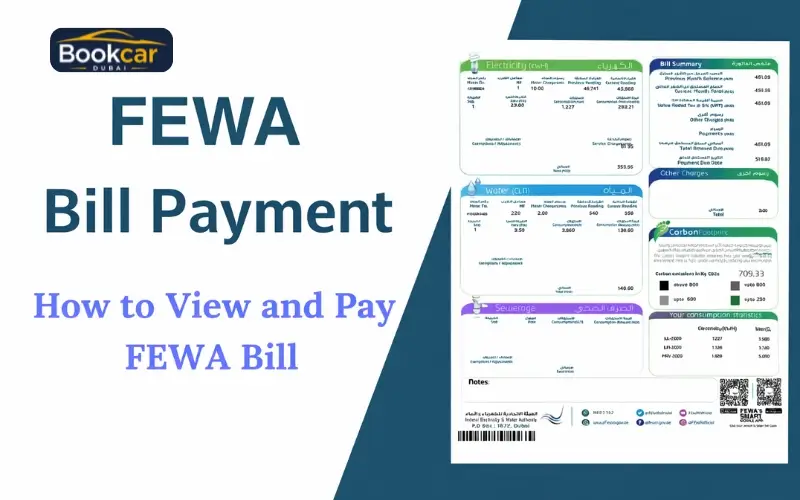

The management of utility bills is an integral part of everyday life for both business and homeowners. Water and electric utilities need to be paid on time to guarantee uninterrupted service and avoid fines. Because of this, knowing how to pay the Fewa bill process is becoming increasingly crucial for those who need transparency, accuracy and speed. It provides a thorough and organized explanation of the billing process and the methods for handling accounts, payment methods and guidance for users. The information is presented in a simple and professional way to make it easier for users to understand the way in which the system operates and what options are available and how to manage Fewa bill payment efficiently, without a haze. After this brief introduction, the most important details related to services are presented in a table format for easy review. The subsequent sections provide comprehensive information on processes, payment channels, digital services, and the best practices. Service Overview and Billing Information Category Details Service Authority Federal Electricity and Water Authority Service Coverage Water and electricity utilities Customer Type Commercial and residential Billing Frequency Monthly Payment Channels Online, banks, and service centers Account Requirement Active customer number Online Access Available Support Availability Customer service centers Understanding the Billing System and Customer Accounts The utility billing system is developed to track consumption accurately and send monthly bills based on consumption. Every customer is assigned an account number that connects all utilities that include water and electricity under one account. The typical bill includes: Consumption details Billing period Balance in outstanding Due date Information on the payment reference Customers are encouraged to look over invoices with care to ensure that they are correct. Any issues should be resolved through the official support channels in order to avoid any future issues. How much a bill payment is a good idea in practice The process for Fewa bill payment can be designed to provide flexibility while ensuring accountability. Payments can be made via multiple channels that are approved and allows users to pick the most convenient method depending on their preferences and accessibility. The standard payment flow consists of: Receiving the bill for the month Verifying consumption and quantity The choice of the payment method Paying the bill prior to the due date A timely settlement ensures uninterrupted service and helps avoid extra charges. Common Payment Methods Available Different payment methods are offered to satisfy the various needs of customers. These payment options are designed to guarantee access, security, and effectiveness. Methods of payment include Online portals Bank channels Authorized service centers Digital payment platforms Each method is secure and follows standards to ensure the security of customer information. Read Also: Ratibi Card Salary Check Digital Services and Online Payment Options Digital services have greatly simplified the management of utilities. Customers are able to access billing details as well as payment history and account information via websites. Online services let users: Check out bills from the past and present. Check consumption trends Receive alerts Pay without having to visit service centers This method saves time and increases the transparency. Read Also: Al Rostamani Balance Check Bill Inquiry and Verification Process Prior to making payments, a lot of clients prefer to look over their bill details. The system has tools to assist with checking balances and reviewing invoices. The option to run the fewa bill check allows users to check the amount of outstanding and billing dates prior to making a payment. This reduces the chance of errors and increases the confidence of the payment. Convenience of Simplified Payment Features Certain users prefer transactions that are faster with no extensive navigation. Fewa bill payment features that are simple have been designed to meet this need. The quick pay feature allows users to make transactions quickly with minimal data, which makes it ideal for customers who already know the details of their accounts. Online Account Access and Usage Monitoring Online access is more than just payment capabilities. Customers can track their usage patterns, look up past billing records and plan their usage more efficiently. With the help of bill check online tools, users are updated on their account’s status and control expenses more effectively. This tool helps with better financial planning and awareness of services. Security and Transaction Safety Security is a top priority throughout all payment and billing procedures. The systems are designed to guard information about customers and block unauthorized access. The security measures are: Transactions encrypted Secure authentication Verified payment gateways Users are advised to only use only official platforms only, and beware of sharing account information with unauthorised third parties. Read Also: How to Fab Balance Check Salary Online Late Payments and Service Continuity Inability to pay charges on time could cause penalties or even service interruption. Knowing the deadlines for billing is crucial to avoid annoyance. Effects of a delayed payment could include: Late fees Temporary suspension of service Additional reconnection fees Monitoring regularly and making prompt payments can help avoid these problems. Business and Commercial Billing Considerations Commercial customers typically manage more consumption and have multiple accounts. A well-organized billing system is essential to ensure the continuity of operations. Companies benefit from: Payment planning with a schedule Centralized management of accounts Regular invoice monitoring Correct handling will ensure the compliance of customers and a continuous service. Customer Support and Assistance Support services are offered to customers seeking assistance on the payment process, billing or account problems. The trained staff members provide advice regarding procedures and resolution of issues. Support usually is provided for: Billing inquiries Payment confirmation Account updates Technical assistance Contacting early can help to resolve issues efficiently. Best Practices for Managing Utility Bills The efficient management of bills eases stress and helps ensure the smooth delivery of service. Customers are urged to develop organized payments habits. The recommended practices include: Setting reminders for due dates Reviewing monthly invoices Using digital services Recording payments These steps aid in financial control and ensure service quality. Read Also: Lulu Salary

Telecommunications are an important part of modern life, supporting people’s communication, business operations, and digital connectivity. To maintain uninterrupted service, fixed-line, mobile and internet providers use structured billing cycles. Customers could be subject to service interruptions and unneeded charges if billing information and payment processes are unclear. Etisalat bill Payment system is a flexible and secure way to manage telecom expenses. By understanding the billing process, payment options and account management, customers can improve their service. This document explains how to bill and pay for digital services, as well as follow best practices. Information is organized to ensure accuracy, clarity and ease of use. Billing information will appear in table format after the introduction. Overview of Service and Billing Categories Details Service Provider Etisalat Services covered Mobile, Internet, Landline Customer Type Individual and Business Billing Cycle Monthly Payment Channels Online Banking and Service Centers Account Requirement Active Customer Number Digital Access You can also learn more about the Customer Support Call Centres and Outlets Understanding Telecom Billing Structure The telecom bill is structured in such a way that it reflects the subscribers’ plans, their usage and any additional services used during the billing period. A monthly invoice that summarises all charges and fees is sent to customers. Invoices include details such as the billing period, service categories and usage breakdowns. Reviewing these details regularly helps customers to verify billing accuracy and better understand their spending patterns. Customers who review invoices carefully can detect potential issues early. Etisalat bill paying works Etisalat bill Payment system is structured to ensure security and convenience. A customer will be notified when a bill has been generated and the amount must be settled by the due date. Customers can choose from different payment methods. Paying on time will ensure uninterrupted service and prevent late fees or service restrictions. Payment Options These payment options are easy to use, secure, and efficient. You can pay using Official online payment portals Digital payment services and banks Authorized Service Centers Each method adheres with approved security standards to protect the privacy and transactional data of customers. Read Also: NBAD Bank Balance Check Salary Card Pay Online and Access Your Account Online Customers can manage their billing and payments online without visiting physical locations. Customers are able to access their invoices, view payment history, and manage service details online. Reminders and notifications help customers pay on time, and keep track of their account. Online account access increases transparency and keeps clients informed about their accounts at all times. Verifying and reviewing monthly bills It is important that customers carefully check their invoices before paying. Verifying the bill ensures that all charges reflect the subscription services. Invoices can be reviewed by customers. Confirm usage accuracy Identify unexpected charges Understanding billing adjustments Verifying your billing regularly increases confidence and reduces disputes. Security and Data Protection Measures The telecom billing system is a key component in ensuring payment security. All transactions are conducted via encrypted channels to protect customer data. Security Measures include: Encrypted payment processing Secure authentication systems Authorized payment gateways Customers are advised to only use official platforms, and not share sensitive data with unauthorised parties. Read Also: Ratibi Card Salary Check It is important to pay on time Paying your bills on-time is essential to maintain uninterrupted service. Late payments may result in additional fees, or even a temporary suspension until the outstanding balance is paid. Payments made on time benefit customers Avoid late fees Maintain continuous connectivity Protect your account standing Setting up reminders or automating payment methods can ensure compliance. Corporate and Business Accounts A billing system is crucial for financial planning and operational consistency. A management system that is effective can reduce the administrative burden and prevent service interruptions. Organization of billing records can help businesses manage costs and comply with regulations. Manage Multiple Services under One Account Many customers use multiple services such as mobile and internet. By consolidating all the charges into a single bill, it is easier to manage. Consolidated billing benefits customers Total monthly expenditures Manage services effectively Missed payments Consolidated billing improves financial control and awareness. Customer Service and Assistance Customer support is available to answer questions regarding billing, payment confirmations and other account issues. Support staff offer assistance via official channels. Support Services Help with: Billing clarification Payment confirmation Account updates Contacting support early can resolve issues quickly, and prevent them from escalating. Billing Issues and Solutions By understanding common problems, customers can respond more effectively. By communicating with the support service and monitoring their activities, you can resolve many of these problems. Proactive account management reduces the likelihood of problems occurring again. Telecom Bill Management: Best Practices Customers who are disciplined in their habits are less likely to have billing issues. These are some recommended practices: Reviewing invoices each month Paying bills before due dates Using digital account tools By following these practices, the service will be uninterrupted and the financial stability is maintained. Future developments in Telecom Billing The user experience will be improved by better digital interfaces and increased automation. The future development could be focused on faster processing, greater transparency and better dashboards for the customers. This improvement is expected to make billing even more user-friendly. Read Also: Lulu Salary Check Comparing Utility Billing Systems While other utilities bill based on consumption, electricity and water bills are based on consumption. Electricity and water bills are calculated based upon consumption. Telecom bills, for instance, include usage metrics and services plans. This helps customers manage multiple accounts better. Read Also: How to Fab Balance Check Salary Online Conclusion: It is important for customers to be organized and knowledgeable in order to avoid service interruptions and unnecessary charges. Etisalat’s bill-payment system is secure, flexible and easy to use. Customers are able to control their telecom expenses with confidence when they use official channels and review invoices regularly. Read Also: Fewa bill payment – Online Process, Methods & User Guide FAQs Can customers view their monthly bill? You may view your

Etisalat offers special data bundles to its UAE customers, particularly during national events or promotional periods. Users actively seek out ways to take advantage of large data bundles, without confusion or misinformation. It is important to understand the eligibility and process in order to avoid expired benefits or failed activations. This guide will explain everything in detail so that Etisalat customers can easily check for availability, use the correct steps and make the most of the data. This article will focus on the official methods, conditions that have been verified, and practical tips for users to understand how these large data offers function, who is eligible to receive them, and what they should do if it does not appear in their phone number. Etisalat Offer 53GB of Data for Free Mobile How to Get 53GB Free Data from Etisalat often tied to special promotions, rewards for customers, or national holidays. These offers may not be permanent, and they can vary depending on the account type, subscription plan, usage history and customer loyalty. This promotion often occurs in conjunction with campaigns that are launched exclusively for UAE residents. It is usually offered as a bonus bundle of data with a set validity period. Depending on the terms of the offer, data can be used for social media, video streaming or certain apps. Understanding the following points is important: This offer is not available to all Etisalat users This offer may only be available to certain customers or prepaid or postpaid customers Data usually has a limited valid time. The activation method can change with time Etisalat 53GB Data Offer: Eligibility Criteria Etisalat does not automatically offer promotional data to all customers. Etisalat determines eligibility and users can’t force an offer manually if the number isn’t assigned. Common eligibility criteria include: Active Etisalat SIM Etisalat Terms and Conditions: No recent breaches Select prepaid or Postpaid Plans Minimum charge or usage history Participation in promotional campaigns The offer may be sent via SMS to some users, and displayed in the Etisalat App for others. If the offer does not appear, this usually means that the number has not been included in the current promotional cycle. Overview Feature Details Offer Name Etisalat (e&) National Day Free 53GB Data Data Allowance 53 GB UAE Local Data Cost 100% Free Eligibility Most prepaid & postpaid users Activation Method Etisalat (e&) App Validity Typically 7 days or until 7 December Usage Type Local UAE data only Hotspot Allowed? Yes One-Time Activation? Yes How to check if an offer is available? Etisalat offers multiple channels for checking if a data offer is available on a particular number. Unofficial sources can lead to inaccurate information. Etisalat Mobile App Etisalat’s app is the best method. After logging in: Click on “Offers” to see your benefits Check available bonus data promotions If the offer is visible, you can activate it directly. SMS Notifications Etisalat sends out promotional messages to all eligible users. These messages may include activation instructions, confirmation links mobile apps or other information. USSD Codes Etisalat provides USSD codes that can be used to check How to get 53 Gb data in Etisalat on certain promotions. These codes are different for each campaign, and they are often mentioned in official messages. Customer Support Etisalat’s customer service can confirm your eligibility and status if the offer is unclear. Step-by-Step activation process Activation is simple if the promotion appears in your number. Depending on whether you use prepaid or postpaid service, the steps will vary. Make sure your SIM card is active and covered by the network. Open the Etisalat App or follow the SMS instructions Accept promotional terms Wait for confirmation message Verify data balance after activation The data is available instantly or within minutes of activation. Data Validity Rules and Usage Rules Use rules are always included with large promotional data bundles. Understanding these rules will help you avoid data loss or premature expiration. Check these points: Validity period is usually 7-30 days If the data is compatible with 4G/5G App-specific or unlimited usage Limitations based on time (daytime use or full day usage) Data that has not been used usually expires at the end of its validity period. There are a few common reasons why the offer may not appear. Users search for 53 GB of data on Etisalat, but they do not see it listed under their number. This does not necessarily mean that there was an error. Some of the most common reasons are: Offer only for selected users SIM activated recently Promotions active on the number Not eligible for certain types of plans Promotion period has ended Etisalat rotates its offers among different user groups. Therefore, future campaigns may have a change in availability. You Should Know Important Terms and Conditions Users should carefully read the terms and conditions before activating any promotional data. Ignoring the conditions could result in an early expiration of promotional data or restricted usage. Conditions that are typical include: One-time activation per number Non-transferable data Some hotspots do not allow sharing via a hotspot Valid only in the UAE Etisalat Fair Usage Policy Understanding these conditions will help users to make the best use of data. Etisalat Promotional Deals Usually Launched Etisalat offers major promotions on specific occasions such as: Celebrate National Day Customer Appreciation Campaigns Offers for the season Recharge-based rewards These promotions are limited and planned well in advance. Users are encouraged to regularly check the official channels for updates. Feature Etisalat 53GB du National Day Offers Data Amount 53GB Varies (often 49GB or bonuses) Activation App-based activation Sometimes auto-credit Cost Free Free Availability Broad user base Varies by plan Ease of Use Very easy Easy, sometimes automatic How to maximize bonus data usage When activated, the data will last for the entire validity period if used properly. Tips for a successful trip: Background app data can be turned off When possible, use Wi-Fi to download large files Etisalat App: Monitor usage Video streaming quality can be adjusted

our money efficiently. When you’re paying bills, withdrawing cash or preparing monthly expenses, knowing the balance that is in your account can help you stay away from financial stress and avoid unexpected deficits. The past was when many depended on branch locations or printing ATM slips, which frequently took time and effort. The advent of digital banking has revolutionized this procedure. With a smartphone, a basic cellphone, and Internet access, customers can verify their account balance immediately at any time. Balance inquiry online atm free services permit you to make this check without any extra costs. When you know the different ways and the benefits they bring it is possible to remain updated on your financial situation and make better financial choices. Online ATM Balance Inquiry Free – What It Means Today The term”online ATM balance inquiry free” is a reference to official bank services that allow users to check the balance of their accounts without charge. These services eliminate the need to visit a branch or print slips, and give easy access to account details via digital channels. Modern banking systems place a high value on speed and efficiency. The ability to access your balance in real-time is useful when you need to verify the validity of a transaction that has occurred recently or checking available funds prior to making the payment. By using these tools, customers can make better financial decisions to avoid delays and effectively manage money. Why Regular Balance Checking Is Important Monitoring your balance on a regular basis offers many advantages. It lets you make informed decisions regarding spending, saving and moving funds. This reduces the chance of failed transactions, overdrafts and unneeded penalty fees. Checking your balance regularly can aid in Online ATM Balance Inquiry Free early. If you find an unusual deduction, reporting it promptly can stop further losses. In time, this routine increases your financial discipline and confidence, which will ensure that you have control over your finances at all times. Digital Methods Available for Balance Inquiry Banks offer several safe and secure digital options to check balances. They are designed to meet the needs of various users while ensuring safety and accuracy. Mobile App Banking Applications Mobile apps are by far the most frequently utilized method. After downloading the official bank app and signing up users are able to log into the app using a PIN, fingerprint, or facial recognition. The app is able to provide real-time transactions, balance updates and alerts on large deposits or withdrawals. Example: A professional with a salary can check their balance instantly after earning the credit for salary, which allows them to plan their bill payments without having to visit a branch of a bank. Internet Banking Through Browser Internet banking permits access to accounts on a secure site. Users can see balances, statements for checks and download the transaction history. This option works on desktops, laptops, and mobile browsers, and is perfect for those who would prefer larger screens or who do not wish to download a mobile application. Example: Small-scale business owners typically make use of internet banking on desktops to reconcile their accounts and confirm the availability of funds prior to paying suppliers. SMS Balance Inquiry The balance inquiry using SMS is designed for people who don’t have smartphones or a stable internet. Sending a predefined SMS from an unregistered mobile number will result in an answer SMS that includes the balance currently. This process is quick and simple. Example: Students who manage allowances can swiftly verify if funds are available prior to making a purchase. Missed Call Banking Missed calls are extremely practical. Customers can call the official bank number on their mobile phone that is registered then hang up and then receive an SMS that contains their balance. This method doesn’t require an internet connection or the installation of an app. Example: The balance of a traveler’s account can be checked via a standard mobile phone when traveling, making sure that they have enough money to pay for everyday expenses. This will ensure that every person regardless of the device and model, is able to check the balance of their account safely and effectively. Safety and Security Considerations Balance inquiry on the internet is safe provided that the proper security measures are taken. Banks secure user data with secured servers, encrypted systems along with authentication layers. Users play an important part in maintaining security. Some essential practices include: Never share your PIN with anyone. OTP Make sure to use official apps and websites only. Beware of public Wi-Fi when using banking services Log out after every session Make sure apps are up-to-date These steps can lower the possibility of theft, fraud as well as data theft guaranteeing a secure balance request experience. How the Balance Inquiry Process Works The digital balance inquiry procedure is straightforward but it is secure. When a user makes an inquiry the bank checks the credentials of the user or their phone number that is registered. If authentication is successful then the system pulls up the current balance and distributes it to the desired channel – app as an SMS, app, or missed calls. The process usually takes a matter of minutes and is secured to protect against data theft. This secure, fast process lets users be confident in the authenticity of their account data no matter where they are – at work, at home, or even while on the road. Security Standards Used by Banks Banks use high-level security precautions to ensure the security of transactions that are digital. Balance inquiry systems rely on secure connections, encrypted connections with multi-factor security. Monitoring in real-time detects suspicious activity immediately. Users can also increase security through: Alerts can be set to alert you of account activity Change passwords regularly and change PINs Making sure devices are secure by using antivirus software The combination of these measures makes balance inquiry online reliable and safe. Are There Any Charges for Online Balance Inquiry? Many banks allow electronic balance

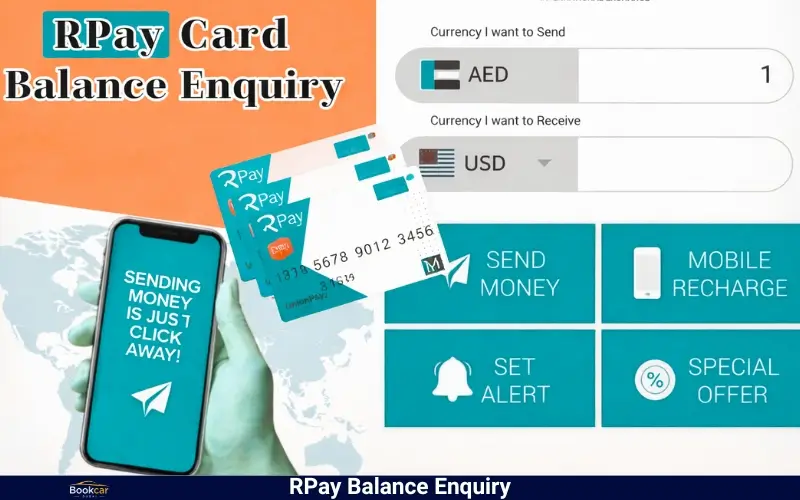

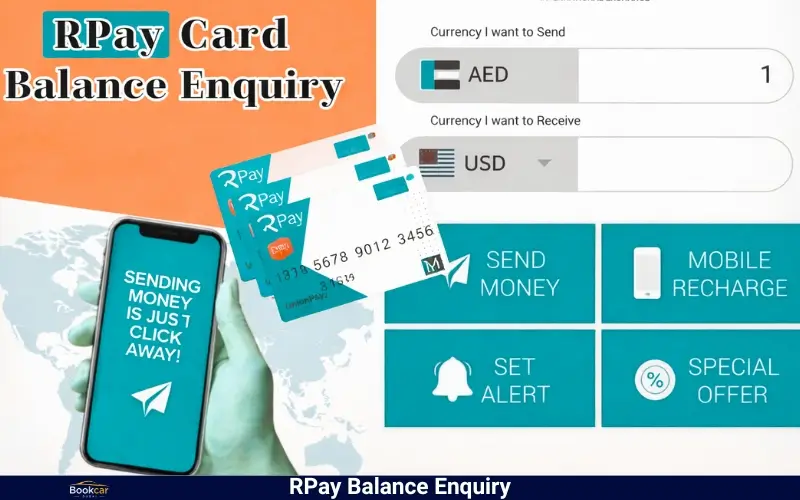

Digital payment systems are an integral aspect of everyday life, allowing transactions to be faster as well as safer and efficient. When you use a virtual wallet to RPay Balance Enquiry for purchases, transfers or bill payments, monitoring your balance is very crucial. A lot of users depend upon RPay services for daily transactions, and often look for reliable methods to monitor the balance of their wallet. This thorough guide will cover everything you must be aware of regarding pay balance inquiry with a focus on the available options for completing the process, step-by-step guidance, common issues, and practical suggestions. The aim is to provide accurate and reliable information to help users control their money without being confused. Understanding RPay and Its Balance System RPay is designed to be an electronic payment system that lets users keep money in a digital wallet and use it to perform various financial transactions. The balance displayed within your RPay wallet is the amount that is available to use immediately, whether it’s for transfers, payments or any other services supported by RPay. Checking your balance regularly can help avoid failed transactions and helps with budgeting and makes sure that enough funds are available for when you need them. Many people prefer reviewing their balance prior to making major transfers or making payments. How RPay Balance Enquiry Works The balance inquiry process is straightforward and easy to use. RPay systems are designed to offer real-time updates, which means that any transaction you make is instantly reflected in your balance. If you look at your balance it determines the most recent balance by incorporating recent payments or top-ups, refunds or deducts. This transparency allows customers to make informed financial choices with confidence. Read Also: Fab Balance Check Methods Available for Checking RPay Balance There are a variety of methods to check the balance of your RPay wallet according to your convenience and accessibility preferences. Each method is created to be safe and simple to use. Mobile App Balance Check and Transaction History The majority of users are able to check their balance using RPay’s official RPay mobile app. After login the balance of their wallet is easily visible in the Dashboard. SMS or Notification Updates Some users are notified of balance alerts by SMS and app alerts following the transaction has been completed. This lets you monitor wallet activities without opening the app each time. Customer Support Assistance If technical issues arise Customer support will confirm the current balance of your wallet after the proper verification of identity. Step-by-Step RPay Balance Enquiry Process In order to avoid confusion here is the most common procedure users use: Open the official RPay Application on your mobile device. * Log into your account using your registered credentials. * Go to the wallet or dashboard section. * Check your balance in real-time This allows for fast access, without the need for the use of any tools or other steps. Common Reasons Users Check Their RPay Balance Balance checks are performed RPay Balance Enquiry by users to fulfill a variety of reasons. They can verify funds prior to making a purchase, or confirming that a last top-up has been successful, or examining the available balances after receiving funds. Regular checks of balances allow users to stay in control of their finances. They also avoid unnecessary failures in transactions. RPay Balance Update Timing Explained One of the main benefits that digital wallets offer is the instant balance changes. In the majority of cases the balance updates are visible within minutes of completing a transaction. But, delays of a short duration can result from system maintenance or verification that is pending. Transaction Type Balance Update Time Wallet top-up Instant Payment is made Instant Refund It may take a bit of time Failure of a transaction Balance remains the same Knowing these timelines can help lessen confusion when checking balances. Troubleshooting Issues During Balance Enquiry Sometimes, users might encounter issues when checking their balance. These issues are usually minor and can be fixed easily. A slow internet connection can stop the application from properly refreshing when you log out, but logging back in and logging back in usually resolves problems with the display. App updates may also alter the balance’s visibility until the installation is completed. If the balance is still in error, contact customer support is a good idea to verify the situation. Security Tips While Checking RPay Balance Do not check your balance in your wallet on Wi-Fi networks that are not secure or public. networks. * Ensure that the RPay application is current to the most recent version. Don’t share login information OTPs, login details, or verification codes. * Turn on PIN protection, or biometric authentication * Log off when using public or shared devices. Check your wallet’s activity frequently to identify unusual transactions Why Accurate Balance Enquiry Matters Accurate information about balances lets users plan their spending, avoid declining payments, and keep confidence in payment systems that are digital. It also allows you to spot any unauthorized deductions, allowing swift action when something is not right. This is why knowing the proper procedure for the pay balance inquiry is crucial for everyone. Difference Between Balance Enquiry and Transaction Histor Balance enquiry displays the available balance in your wallet at a certain time. It helps users quickly verify the amount of funds available to make a purchase. Transaction history is a comprehensive history of previous transactions that includes top-ups, payments or refunds, as well as deductions. It is beneficial to card ID look through transaction history to track spending and confirm the authenticity of transactions. Together, these two features provide the complete overview of the usage of your wallet. Tips to Maintain a Healthy RPay Wallet Balance An adequate balance can ensure continuous access to RPay services. People who depend on digital payments must regularly check their accounts and schedule topping-ups ahead of time. * Check the balance of your wallet frequently * Make sure you top up prior to

Salary verification is an essential aspect for employees who work in large corporations and banks linked payroll systems. A timely confirmation of the credit for salary assists individuals in managing their expenses, plan savings and prevent unnecessary financial strain. If employees do not know their salary status, even tiny delays can cause confusion and even anger. FAB Salary Accounts are typically employed for payroll particularly for employees within structured organizations. Many employees search for correct data because they don’t know which way to check their balance of salary correctly. Unofficial or incorrect methods can result in inaccurate assumptions. How Fab Balance Check Salary Works Fab Balance Check procedure lets employees confirm that their wages have been paid into your FAB account. Salary is processed typically through the payroll system used by employers and then transferred to the employee’s personal bank account. After the payroll processing has been completed, the credit amount is visible on the official channels of banking. Balance checking doesn’t change or alter the amount of salary. It only gives confirmation of the status of the payment. This process is beneficial to employees who rely on proven systems, not rumors or beliefs. Why Salary Balance Verification Is Important The salary is usually the main source of revenue, which makes verification crucial for financial planning. If employees aren’t verified, they could be faced with difficulties managing expenses like rent, bills, or other expenses that are commonplace. Some of the main reasons for Fab Balance Check Salary verification concerns are: Payroll credit confirmation on time Recognizing payroll delays in the early stages The planning of monthly expenses should be precise. Beware of stress that is not needed The reduction of HR queries The proper verification of employees gives them confidence. Learn the Main Methods to Check Salary Balance The majority of employees are provided with multiple methods to confirm the balance of their salary. Each method has a specific use based on the accessibility and preferences. Bank Account Balance Inquiry The most reliable way is to check the FAB balance of the bank account directly. After the money is credited, the amount is reflected in the balance of the account as well as the transaction history. This method is reliable and does not require any third-party services. Mobile Banking Application Fab Balance Check Salary provides mobile banking capabilities which allow customers to view the balance of their accounts, transactions history, and credit for salary immediately. Employees are able to log in with their credentials securely. This method is simple and can be used for routine monitoring. ATM Balance Check Employees can also check their balance at FAB ATMs with your debit cards. This is a great option in situations where internet access is not available. ATM checks verify the status of your balance in real-time. Salary Credit Process Overview Stage Explanation Processing of payroll Employer calculates salary Transfers to banks Salary paid to FAB Credit confirmation The amount is reflected in the account This guideline helps employees understand what causes delays. Common Reasons for Salary Delays There are many reasons for delays in salary. mistakes. Several routine factors can affect processing time. Common causes are: Public holidays Bank processing schedules Incorrect account details Employer payroll delays Maintenance of the system The identification of the root causes can help employees react calmly and efficiently. How New Employees Can Check Salary The new employee is often confused in their first pay cycle. The dates of joining and the cut-offs to payroll may affect the first payment. New staff should Confirm account details during onboarding Know the dates for salary cut-offs. Check balance after expected payday If delay persists. This method eliminates the need for unnecessary stress. Role of Salary Statements The salary statements contain detailed details on earnings and deductions. While they aren’t able to confirm the credit immediately, they do serve as a formal proof of the processing of your salary. The employees should review their salary statements regularly and save their salary statements to record their earnings. Regional Payroll Considerations The timeframe for processing salary may differ depending on the regional bank rules. Employers who work in the UAE might experience different processing times due to local regulations and banking rules. Knowing these aspects can help set realistic expectations. Read Also: PPC NBAD Balance Check How Often Should Salary Balance Be Checked Salary balances don’t require to be monitored daily. Employees should be aware of their credit date expectations. The recommended frequency is: Monthly employees: Once near payday New employees: twice during first month After the holidays: Once the post-processing is complete, Routine checking reduces stress. Handling Salary Discrepancies If the amount credited is less than anticipated, employees should first look over the salary statement. The majority of the differences are due to the deduction of absences or absences, as well as the need to make policy changes. The steps to follow: Review statement details Compare attendance records Contact payroll and provide proof Do not make assumptions based on informal information. Structured communication allows for higher resolution. Security and Privacy Awareness The information about bank and salary is highly sensitive and needs to be secured. Employees should be cautious about sharing the login details or screen shots. The best practices are: Use only official apps Logging out of access after access Beware of the public network Privacy of information Security awareness safeguards financial information. Final Summary The verification of salary is an important aspect of financial management for employees. Understanding the process of salary credit and knowing the best place to look for precise information can ease anxiety and confusion. This Provided verification methods as well as timelines, common issues and security best practices in an easy and professional manner. A properly-designed balanced check of salary can help employees to stay on top of their finances and keep well-organized. Read Also: Ratibi Card Salary Check Frequently Asked Questions How do I verify that I have a salary credit in my FAB account? You can check the balance of your

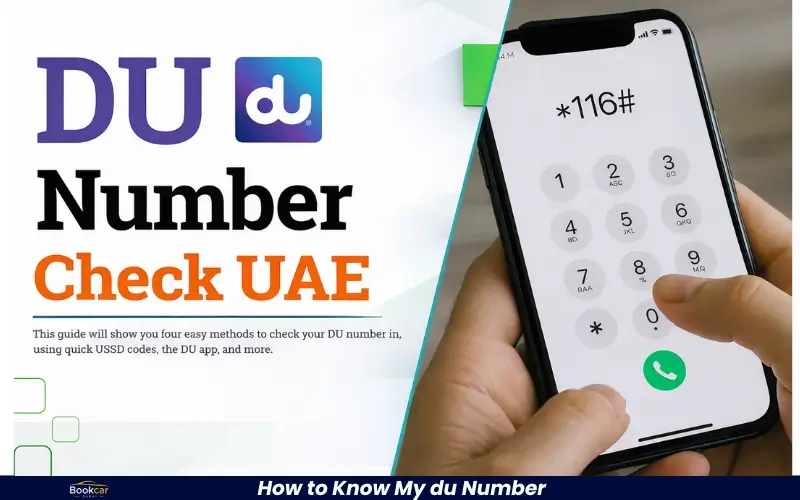

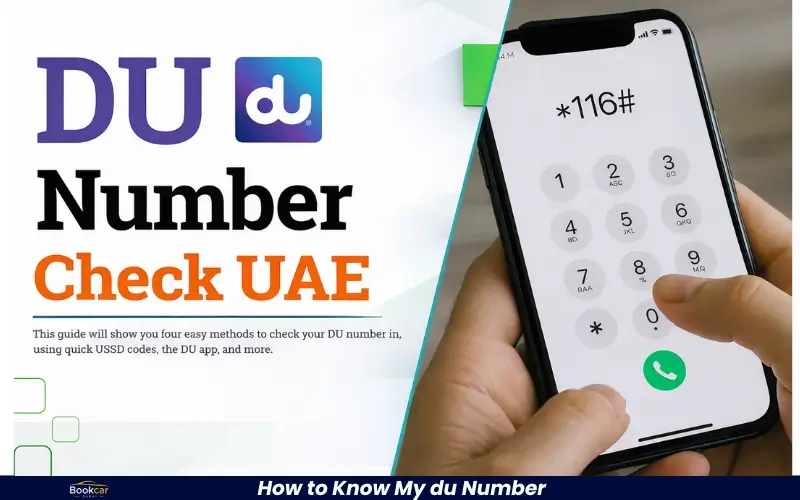

It is a common problem for mobile users to forget their own phone number. It usually occurs when a SIM is used for the first time, temporarily or in a second phone. In these situations, people are looking for reliable and clear information about how to find my du number. They don’t want confusion or extra steps. It is essential to have your mobile number available for communication, account verification, registration on apps, and online forms. There are multiple ways that telecom providers provide to retrieve a phone number. However, not all users know about them. Some methods are instant, whereas others are dependent on the phone’s settings or documentation. This article explains each practical option in an organized and simple way, so that users can easily identify their number and store it for future usage. Each method is carefully explained to ensure accuracy, clarity, and easy understanding. Why knowing your mobile number is important It is important to know your mobile number. It is essential for many services, such as banking alerts and account logins. Delivery confirmations and official communications are also dependent on it. You may experience delays or verification problems if you don’t have access to your number. You will also need your mobile number to contact customer service, activate services or recover online accounts. It can be stressful to forget your number, especially in an emergency situation. Knowing how to find my du number allows you to remain in control and not depend on others for basic information. Users forget their number in these situations Many people forget their mobile number. Many people insert new SIM cards into their phones to test them or for temporary purposes, but they do not memorize the numbers. Some users have multiple SIM cards, and they mix them all up. Some users rely on their saved contacts, and seldom dial their own number. A common scenario is the use of SIMs that are only for data or SIMs stored in backup phones or tablets. These users might not have ever made a phone call or sent a text message. It is easy to forget this number. These scenarios show why it is important to provide clear instructions in order to retrieve a number reliably and quickly. Use USSD code to check your number Dialing a USSD Code from the SIM is by far the most popular and direct method. This method doesn’t require an internet connection, balance or any special settings. This method works on both smartphones and basic phones. This is the most popular solution when users ask how to find my du number because it’s fast and official. The USSD system is a direct communication with the network that displays the number in seconds. It is easy to use and suitable for users of all levels, even those with little knowledge of smartphone settings. You can check your number by calling another phone A simple way to do this is to send a text message or call a phone nearby. The number will appear on the screen of the recipient when the call is made. This method is effective when there is a balance and the network conditions are stable. This method is simple, but you will need a second device and enough credit. This is a good backup option if the USSD codes are not working or temporarily unavailable. Find the number through your phone settings Some smartphones store the SIM card number automatically in their system settings. The user can find their number in the information menu of their phone. This method only works if the SIM number was correctly saved during SIM activation. The exact path can vary because different phone manufacturers have different interfaces. This option is not universally available, but it may be useful for those who do not want to dial codes or place calls. Official Mobile App: Check it out The official app for mobile devices provides the account information, including the number, to users who already have registered their SIM. The number will usually be visible after logging in using a one-time passcode. It is not suitable for new users as it requires Internet access and registration. It is useful for tracking service and managing your account. Use SIM Card packaging or purchase documents The number of a SIM is usually printed on the original packaging, or the receipt. These documents allow users to quickly find their number even without a phone. The method works well for new SIMs, but it becomes less reliable over time when documents are lost. Even if you don’t know if the SIM has been purchased recently, it is worth checking. Contacting Customer Support The only option left is to contact customer service if none of the methods you have tried work. After verifying your basic details, the support staff can retrieve your number. This ensures safety and prevents misuse. It may take longer than other methods, but the results are guaranteed to be accurate. This method is particularly useful if the SIM card is not active or is inserted in a device which cannot display the number. Common issues users face when checking their number USSD codes can cause delays or errors for some users. It could be due to temporary service interruptions or network congestion. Some people find that the phone setting does not display their number correctly. Users may in rare cases have an outdated SIM or incomplete registration information, which can cause retrieval issues. Understanding these issues allows users to remain patient and use alternative methods rather than assuming that the SIM is defective. How to avoid forgetting your number again It is important to know my du number as you find it. It can be stored in your contacts with a name that is easy to remember or written down somewhere safe. Some users take a picture of the SIM packaging as a backup. Save your number to avoid having to search for it again and make daily tasks

Gratuity is among the most important benefits of ending service that employees receive throughout the UAE. It is a way to ensure financial security after years of service, and is protected by UAE labor law. In spite of its importance, many employees are in confusion about how gratuity is calculated, which elements of salary are included and how it affects their resignation or termination final amount. This comprehensive guide explains how to calculate gratuity in the UAE in a straightforward and professional manner. It focuses on laws as well as real-world explanations and practical understanding, not technical terminology. If you’re an employee preparing for your future, or an employer looking to ensure compliance with legal requirements This article will provide comprehensive and accurate details. Gratuity Calculator UAE and Legal Foundation Gratuities in UAE are subject to Federal Decree-Law No. 33 of 2021. This law establishes the rights of employees and employers obligations. According to this law, gratuities are paid to employees who have at least 1 year continuous employment with the same employer. A calculator for gratuity UAE can be designed in order to follow these rules of law automatically, however it is not able to substitute for a thorough knowledge. The law is clear that gratuity should be calculated using the basic pay and the total duration of service with specific restrictions. Understanding Basic Salary in Gratuity Calculation The calculation of gratuities in the UAE is based solely on the basic salary. This is among the most misunderstood topics among employees. Basic salary is the portion of a month that is fixed pay that is set by the employer in their employment agreement. The components of a salary that aren’t considered gratuity are: Housing allowance Transport allowance Rewards and bonuses Because these components aren’t included the employees are more likely to overestimate the amount of gratuity they receive. To get accurate results, only the salary specified in the contract is utilized. Length of Service and Its Impact on Gratuity The amount of time the employee how to calculate gratuity in uae has worked for plays a significant factor in the calculation of gratuities. UAE labor law breaks down time of service into two groups that are the first five years, and the time after five years. In the initial five years, gratuities are assessed at a less amount in comparison to service after five years. This arrangement encourages long-term work and also ensures the fairness of shorter periods of service. Additionally, there is a limit set by law for gratuity. The amount of gratuity cannot be more than two years’ base salary regardless of the length the employee has been working. Gratuity Calculation (Standard UAE Rules) Service Duration Gratuity Rate Calculation Basis 1-5 years Every year, 21 calendar days Basic salary / 30x 21 Over 5 years A total of 30 days in the calendar Basic salary x 30 x 30 Maximum cap 24 months Legal maximum amount This table shows the basic formula that is used across the UAE to employees who are eligible. Contract Type and Gratuity Entitlement Contracts for employment in the UAE generally fall into both limited and unlimited categories. The type of contract affects the amount of gratuity that is allowed, particularly when it comes to resignations. Employees who sign a limited contract usually receive an entire gratuity. However, leaving prior to the date of expiration may decrease or even cancel gratuity, based on the contract terms. Unlimited contracts allow for greater flexibility. Employees are still eligible for gratuity benefits even when they quit in the event that they have not completed the minimum mandatory service duration. Resignation and Termination Effects on Gratuity The amount of gratuities paid varies based on the manner in which employment is terminated. The termination and resignation processes are treated differently in UAE labor law. In the case of resignation, gratuity benefits are contingent upon years of service as well as the contract type. Early resignations can result in lower benefits, whereas long-term service usually allows the entire gratuity. A termination by an employer typically will result in a full gratuity payout with the exception of cases involving serious violations. Lawful misconduct cases could result in the termination of the rights to gratuity. Practical Gratuity Calculation Example Imagine an employee who earns the basic pay of AED 4,500 after 7 years continuous employment. In the initial five years, the gratuity will be determined at 21 calendar days a year. In the following two years, this amount rises to 30 days per calendar year. The calculation is a combination of both parts which results in a larger amount of gratuity once you have crossed the threshold of five years. The same principle is used to internal processes by the HR payroll and online tools. systems. Understanding this structure can make the process of the calculation of gratuity in the UAE significantly easier, without having to rely entirely on tools that are automated. Common Errors Employees Should Avoid A lot of disputes over gratuities arise because of miscommunications, not legal infringements. The most frequently cited disputes include: Utilizing a total salary instead of the basic salary Not paying for unpaid leave Misunderstanding contract type The employees who can clarify these points early will save themselves from disappointment at the conclusion of their employment. Employer Responsibilities Under UAE Labour Law Employers are legally required to pay gratuity in a timely manner. Payouts must be made within 14 days of the date of the employee’s last day of work. Employers must also keep accurate records gratuity calculator uae of their employees which include salary structure as well as the duration of service. Infractions could result in penalties, labour complaints and legal enforcement. Importance of Gratuity Awareness for Employees Understanding how you can calculate gratuities in UAE assists employees in planning their financial and career plans effectively. It also aids in negotiations for contracts and job shifts. The awareness of gratuities ensures that employees get their legal benefits and safeguards employees from unfair

Transparency of salary is one of the most crucial financial necessities for workers working within the UAE. A lot of workers depend on online salary accounts or cards that are linked to Lulu finance services, to earn monthly pay. Since expenses for daily living such as transportation, rent, grocery and utility bills all depend on the availability of salary, knowing how to run the Lulu salary check is crucial for the financial stability of. Employers often want to know that their wages have been paid, what amount has been paid out and if deductions are being applied properly. This provides everything that is to salary checking for accounts linked to Lulu in a simple and straightforward method. The article also describes how the Lulu Banking Balance Inquiry can play a crucial function in confirming the validity of salary credits as well as avoiding unsuccessful withdrawals and preparing your monthly expenses. This article is aimed at UAE employees and salary card holders and everyone who depends on the services of Lulu-based banks to gain access to income. Lulu Salary Accounts in the UAE Lulu’s salary accounts are widely utilized by private-sector businesses as well as service companies across the UAE to pay employees wages. They are designed to provide ease of use, and allow employees to get paid without opening an account at a traditional bank. Many employees use these accounts to make ATM withdraws, credit card payment as well as local transfers. When conducting a salary check, employees generally use Lulu Bank Balance Enquiry methods to verify whether their salaries were paid. Balance enquiry tools enable users to check their account in real-time information, guaranteeing transparency and accuracy. Salary accounts are particularly sought-after for employees who need easy access to their earnings without the hassle of banking. The salary accounts associated with Lulu services are governed by UAE rules on finance, which guarantee security and reliability. However, the employees must be sure to check their balances frequently to avoid confusion arising from late payments or incorrect pay amounts. Why Lulu Salary Card Important for Employees A lulu paycheck check regularly keeps employees informed about their financial situation. Incorrect credits, salary delays or payments that are not made can result in stress if they are not detected in time. Paying on time can allow employees to voice concerns with their employers prior to when the financial obligations of the company are impacted. With Lulu’s Account Balance Check, customers are able to instantly verify whether their paycheck is being credited. This assists in coordinating the payment of rent or loan installments as well as everyday expenses. This also helps avoid unnecessary trips to service centers or ATMs in the event that funds aren’t available. The main reasons why salary checks is essential are: Confirming the date of credit for salary and the amount Identifying delayed or missing payments Beware of ATM withdrawals that are declined ATM withdrawals The best way to plan monthly expenses is to do it efficiently. Maintaining financial confidence Regular salary checks aid in better money management and decrease the risk of being in a state of uncertainty. How Lulu Salary Check Works A Lulu salary check is basically the process of confirming salaries through balance enquiry channels. When an employer processes payroll, the pay is credited to the employee’s Lulu linked account. The employee then has the option of confirming the credit by using methods that are approved. The majority of employees depend on Lulu Bank Balance Enquiry options like mobile applications, web-based portals, ATMs, and customer support. These options show the current balance that includes the salary deposit once it has been processed. Certain platforms also display the history of transactions, which allows employees to view the salary description along with reference numbers. Salary credit usually shows up only on days that are working, and depend on the payroll schedule of the company. A check of the balance prior to payday could show the prior balance up until the salary is processed. Lulu Salary Check Methods Overview There are many ways to get a pay check, based on access and ease. Salary Check Methods Method Internet Required Availability Suitable For Mobile application Yes 24/7 Daily users Online banking portal Yes 24/7 Home or office users ATM balance inquiry No 24/7 Access to the internet offline SMS alert service No Limited Basic phone users Customer support No Hours of operation Need assistance Each method gives you access to information about salary when it is used in a manner that is appropriate. Checking Lulu Salary Using Mobile Banking Mobile banking apps are the most efficient method to conduct an Lulu salary-check. After logging in users can check their balance on their account and view transactions history immediately. Salary credits typically appear with a reference to the employers’ names or payroll. Utilizing Lulu Bank Balance Enquiry through mobile apps lets employees access their pay at any time and from any location. This option is perfect for employees who require immediate updates, without having to visit the ATM or service center. A lot of apps will also notify you when a salary credit is made. Mobile banking is a good option for employees who earn a salary often and need an ongoing financial overview. Online Lulu Salary Check Through Banking Portals Online banking portals give the complete view of your pay-related transactions. Employees can sign in using laptops or computers to access account summary reports and transaction history. This is a great option for those who wish to download statements or check pay records for use in official documents. With Lulu Bank Balance Enquiry on websites, employees are able to check not only their salary credit but also transfers or deductions. This technique is especially beneficial when employees have a variety of financial obligations. Online banking is stable and provides precise reporting, which makes it suitable for long-term wage tracking. ATM-Based Lulu Salary Check ATM balance inquiry remains among the top reliable methods to verify your salary. Employees can use

The best way to manage your finances is by being aware of your funds available. In the UAE the majority of residents depend on Lulu-linked banking and financial services to pay their salary as well as transfers and other regular transactions. Knowing when and how to check your balance will help you avoid rejected payments, unanticipated fees and stress on your finances. This comprehensive guide explains how to inquire about your bank balance with Lulu in a clear and straightforward manner. This guide is geared towards salaried employees, those using salary cards as well as regular account holders who require clear information, without any technical ambiguity. Lulu-Linked Banking Services in the UAE Lulu Bank Balance financial services are widely utilized in the UAE to pay salary disbursement in remittances, payments, and for the basic banking requirements. A lot of people rely on these services to access monthly cash access to income, ATM cash withdrawals as well as payment via credit card. Because these accounts are frequently utilized for daily expenditures, checking account balance becomes a daily obligation rather than a once-in-a-while job. The options for requesting balances are created to accommodate different needs of users. Some like mobile applications, whereas others depend on ATMs or customer service. Understanding the various options lets customers select the most secure and convenient method. Why Checking Your Account Balance Regularly Matters Regular checks of balances are Lulu Bank Balance Enquiry for ensuring financial control. They allow users to confirm that they are receiving payments and keep track of expenditures that have been incurred without waiting for monthly reports. Balances are checked frequently, which can be helpful to users: Confirm allowances and salary credits Beware of declined transactions with your credit card. Plan withdrawals and transfer Check your spending habits Avoid overdrafts or problems with balances that are not sufficient For employees as well as salary card holders, this practice aids in spending and stability in the financial. Overview of Available Balance Enquiry Methods There are a variety of methods that are official and effective to check the balance of your account. Every method comes with its benefits in relation to access time, frequency, and preference. Balance Enquiry Methods Comparison Method Internet Needed Availability Suitable For Mobile application Yes 24/7 Daily users Online banking portal Yes 24/7 Home or office users ATM inquiry No 24/7 Access off-line SMS or SMS / (if enabled) No Limited Basic phone users Customer support No Hours of operation Assistance is needed The knowledge of these options guarantees continuous access to the account details. Checking Balance Using Mobile Banking Applications Apps for mobile banking are among the quickest and easiest ways to monitor balances. They are updated in real time and offer other account features like transaction history and alerts. After downloading the official application that has been connected to the banking service, users sign in with secured credentials. The dashboard for the account shows the balance of their account in real-time. A lot of apps show the most recent transactions to help users keep track of their spending without additional steps. Mobile apps are great for those who require easy access when traveling or managing their finances on the move. Online Banking Balance Check The online banking websites are ideal for customers who want bigger screens and an extensive view of their accounts. They are accessible via official websites by using secured login credentials. Once they have logged in, users are able to view their summary of their account, which contains the balance available and most recent transactions. This feature is beneficial to those who manage financial matters from the comfort of their home or work place, as well as for those who download their statements or check the history of transactions regularly. Online banking provides a reliable and complete overview of the activity of your account. ATM Balance Enquiry Process ATM balance inquiry remains among the top commonly used techniques, particularly for those who do not have internet access. It is compatible with credit as well as ATM cards issued by banks or other institutions that partner with it. The procedure involves inserting the card by entering the PIN and then selecting the balance inquiry option. The balance that is available will be displayed on the screen and a receipt printed can be obtained in the event of need. ATM Balance checks can be safe and are accessible throughout the UAE however, some machines may charge a modest service charge based upon the service provider. SMS and USSD Balance Enquiry Options Certain banking platforms offer SMS and USSD balance enquiry options. These are great options for those who use basic mobile phones, or who have limited internet connectivity. If they are supported, users can send an individual SMS to dial an appropriate number using their registered mobile number. The balance will be returned by text message within a few seconds. It is dependent on the banking service provider and the type of account. Users must confirm their activation and the supported formats by contacting the official customer support channels. Customer Support and Branch Assistance Support for customers remains a reliable option in the event that ATM or digital methods aren’t available. Customers can call the helpline of the bank to request the balance of their account following identity verification. Service counters or branch visits can also be beneficial when balance inquiries are paired with other issues related to accounts. This is particularly useful to resolve discrepancies or update information about your account. Salary Account Balance Checks A large number of UAE residents make use of Lulu linked accounts to deposit salary. For those who use Lulu the balances must be checked following the date of payroll processing. Regular checks of balances help ensure that the salaries are being credited correctly and in time. This is crucial for controlling the payment of rent utilities, rent, and other monthly expenses. Utilizing digital methods, those with salary accounts to confirm credits immediately without having to visit branches. Common Issues Users

BookCarDubai, your reliable car rental partner offers affordable and reliable cars for all needs. We offer a wide range of vehicles, from compact cars to luxury SUVs.

Book Car Dubai © 2026 | All Right Reserved