The ability to manage your monthly income efficiently is vital, especially for those who depend on pre-paid salary cards rather than conventional bank accounts. The Ratibi card salary check process assists workers throughout the UAE verify salary deposits to track spending and avoid any unnecessary ATM or merchant-related issues. This guide is intended for employees, laborers and businesses using the Ratibi payroll system, who require accurate, precise and practical data.

Ratibi Cards are frequently employed by businesses that are registered under the UAE Wage Protection System (WPS). These cards provide a secure and easy way to pay salary without having to open a bank account. Understanding the way that salary crediting works and how to access the funds, and what options are offered can help you save time and avoid confusion.

Ratibi Check Balance and Salary Verification Methods

The process of checking your salary balance is among the most important things for cardholders. Ratibi cardholders have a variety of authentic ratibi check balance and safe methods to verify the credit on their salary and the remaining balance. They have been designed so that they are available even to those who do not have phones or internet access.

ATM Balance Inquiry

Visit any ATM of ADCB across the UAE to verify your balance. Insert your card, type in your PIN, then choose an option to inquire about your balance. The screen will show your current balance instantly.

SMS and Phone Banking

Some employers offer SMS-based alerts to send salary credit notifications. Furthermore, ADCB phone banking support will assist ratibi balance enquiry cardholders with balance-related issues following identity verification.

Salary Credit Timing

The majority of salaries are credited within 24 – 48 hours after the employer has processed the payroll via WPS. Weekends and holidays can cause delays in updates.

What Is a Ratibi Card and Who Can Use It?

A Ratibi card can be described as a pre-paid payroll card that is issued from Abu Dhabi Commercial Bank (ADCB). It’s specially designed for those who don’t have traditional bank accounts, but require a secure option to get their earnings.

Eligible Users

- Private sector employees

- Domestic workers

- Construction and labor personnel

- Small business employees covered under WPS

Key Benefits

- It is not necessary to create an account at a bank

- Deposits for salary security

- Simple ATM withdrawals

- Accepted in major retail outlets

This system helps to ensure the financial inclusion of all employees and guarantees the transparency of employers and employees.

Salary Withdrawal Options in the UAE

When your paycheck is paid after which you are able to withdraw cash or use your card directly to make purchases. Understanding the channels for withdrawals can help you avoid additional charges.

ATM Cash Withdrawals

Ratibi card can be utilized at ADCB Ratibi card salary check ATMs as well as select partner machines. The use of ATMs that are not network-connected could cause additional fees.

Point-of-Sale (POS) Payments

The card can be used at pharmacies, grocery stores and malls, as well as fuel stations as well as restaurants throughout the UAE everywhere card cards are accepted.

Daily Withdrawal Limits

There is an annual limit for cash withdrawals that is set by the bank that issued them. This limit helps protect users from overspending and fraud.

Fees and Charges You Should Know

Although Ratibi cards are affordable, some services can come with fees. Be aware of these charges to help to manage your income effectively.

| Service Type | Approximate Charge |

| Checking balance at ADCB ATM | Free |

| ATM withdrawal of cash at ADCB ATM | Minimal or free |

| Refund at a different ATMs at the bank ATM | Small fee |

| Replacement of a card | Applicable fee |

| PIN reset | Usually, there is no cost |

Charges can vary based on the terms of agreements between employers and bank policies.

Common Issues and How to Solve Them

Certain cardholders are faced with issues due to their salary credit or card use. The majority of problems can be addressed swiftly if you follow the correct steps.

Salary Not Credited

- Check with your employer to confirm the date for payroll.

- Verify if WPS submittance was successful

- Be patient during processing times on holidays.

ATM Card Not Working

- Verify that you have entered the correct PIN

- The expiration date for your check card

- Go to an ADCB branch to get assistance

Lost or Stolen Card

Make a report immediately to ADCB customer service, who will remove the card, and ask for the replacement.

Employer Responsibilities Under WPS

Employers play a crucial function in ensuring timely payment. As part of the Wage Protection System, companies have to submit accurate data on their payroll and transfer wages on time.

Employer Obligations

- Processing of your salary on time

- The correct employee details

- The compliance in accordance with UAE labor laws

Failure to adhere could result in fines and delayed payments to employees.

Security Tips for Cardholders

It is vital to safeguard your earnings. Implementing basic security measures will help you avoid fraud and insecure access.

- Don’t share your PIN with anyone.

- Avoid using unfamiliar ATMs

- Report suspicious transactions immediately

- Make sure contact information is up-to-date

These simple habits ensure your funds remain safe.

Advantages of Using Ratibi Cards Over Cash Payments

Moving between cash and Ratibi Payroll cards that are prepaid offers many benefits to employees and employers which makes salary distribution more secure and efficient.

Transparency

Every salary transaction is digitally recorded to ensure transparent and traceable payments. This decreases the risk of disputes and errors between employees and employers.

Convenience

Employees have access to their funds anytime, without being confined by the hours of work. They can cash out purchase items, withdraw cash, or pay for bills whenever they want, offering flexibility and simplicity.

Safety

Utilizing Ratibi cards greatly reduces risks of handling cash including theft and loss. Digital transactions are safer and safeguard both employers and employees from financial disasters.

| Benefit | Description |

| Transparency | Digital records ensure that all pay stubs are traceable which reduces dispute |

| Convenience | The ability to access funds at any time allow employees to cash out pay at any time |

| Safety | Risk of loss and theft when as compared with handling cash |

In the end, Ratibi cards streamline salary management and offer safer more transparent and more convenient alternatives to cash-based transactions.

Support and Customer Service in the UAE

ADCB provides dedicated support to Ratibi card holders via helplines, branches, as well as authorized service centres.

Available Support Channels

- ADCB branches

- Telephone bank

- HR help for employers

Support teams assist with balance inquiries as well as card replacement and technical problems.

Why Understanding Salary Access Matters

Understanding how your system for salary can help you plan expenditures, send remittances and effectively manage your monthly budget. People who are constantly monitoring their accounts will be less likely to experience problems with their payments that are unexpected.

Making use of the Ratibi pay check procedure carefully will ensure that your earnings are always available when you need them.

Related Article: NBAD Bank Balance Check Salary Card

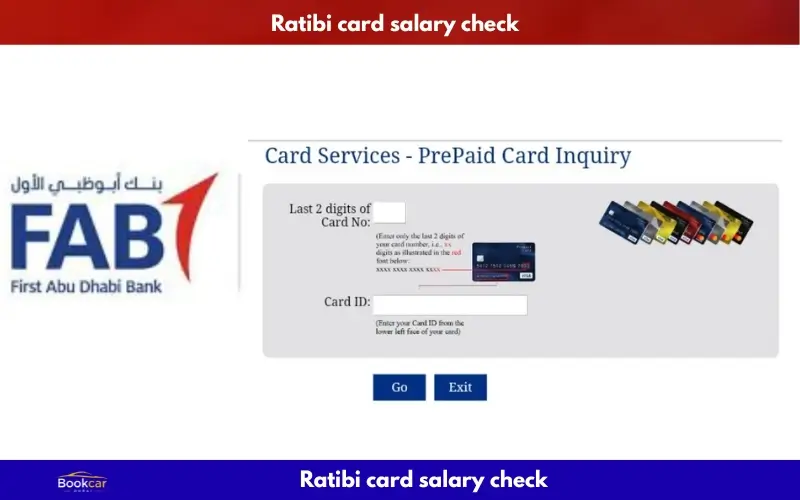

Related Article: FAB Balance Check Quick & Easy Methods

Conclusion

The Ratibi Salary System makes wage allocation easier and safer for a large number of employees throughout the UAE. Understanding how salary crediting is done, where to draw funds and how to fix frequent issues, customers can save themselves from unnecessary stress. If you’re new to the concept of prepaid payroll cards or have been using them for years being informed will ensure an easy access to your earnings. A thorough grasp of Ratibi card’s salary check procedure lets you manage your financial matters with confidence, and with peace of mind.

Frequently Asked Questions (FAQs)

What is the time frame for the salary to show up in the account?

The salary is usually paid within 24 to 48 hours after an employer has processed pay through WPS.

Are there any cards that I can use in the UAE?

Ratibi cards are designed primarily for use in the domestic market and are not able to work internationally.

Do there exist any minimum balance requirements?

There is no minimum balance requirement to maintain the card.

What do I do if I forget my PIN?

The reset option is by going to any ADCB ATM or by contacting customer service.

Can my employer track my spending?

Employers are able to view the salary transfer confirmation but not personal expenditure details.