The pre-paid cards for payroll are used widely throughout the UAE to aid employees in receiving pay and pay for their expenses with ease. These cards are most popular for those whose wages are processed by banks that have approved systems. The most commonly searched topics for salary cards is the balance check as cardholders need a speedy and secure method to verify that they have enough funds.

The prepaid cards issued by NBAD were designed and developed to make prepaid cards safe, accessible and simple to use for cash withdrawals as well as purchases and monitoring balances. Knowing how balance checking works can help cardholders prevent declined transactions, reduce expenditures and plan withdrawals correctly. This article offers a comprehensive and concise explanation of NBAD Balance checking for prepaid cards card features, card restrictions, usage and customer support. written in easy but professional terms.

The National Bank of Abu Dhabi, also known as NBAD, was an important financial institution in the UAE banking sector. It provides a range of services, including prepaid pay cards that companies use to pay employees’ salaries to ensure compliance with wage protection programs.

NBAD Prepaid payroll cards aren’t traditional bank accounts. They are instead cards that store value and where salaries are loaded on a monthly basis. Cardholders can utilize these cards to make ATM withdrawals, shopping as well as balance inquiries, which makes them an ideal solution for all your financial requirements.

Understanding PPC NBAD Balance Check

A balance check lets cardholders view the current balance on their account. This ensures that transactions are made successfully and helps avoid problems with overdrafts. Balance check ppc nbad is typically employed by employees who earn salary via NBAD-issued prepaid prepaid cards.

Balance checking doesn’t affect the value of your card and is able to be performed several times as required. It is a crucial practice for those who use pre-paid cards to pay for their daily bills, expenses and cash withdrawals.

Prepaid Card Enquiry and Balance Awareness

A prepaid card inquiry helps users verify the status of their salaries, track spending and detect any irregular deductions. Regular inquiries allow cardholders to remain informed, without having to visit banks often.

By keeping an eye on balances, employees are able to better plan withdrawals and avoid failing transactions at ATMs and retail outlets. Balance awareness also helps with more efficient planning and budgeting as well as financial discipline.

Methods Available for NBAD Balance Inquiry

NBAD offers several choices for cardholders who want to check their balances. The options are created to accommodate different preferences of users and levels of access.

The majority of balance inquiry options are ATM Balance checks, client support and online banking channels. Each method is accurate and provides actual-time balance information.

NBAD Balance Inquiry Mobile Options

| Method | Availability | Description |

| ATM Balance Check | Yes | Check balances via NBAD or other ATMs |

| Customer Support | Yes | Balance confirmation via assistance |

| Digital Platforms | Limited | Mobile- or online-based solutions |

| Bank Branch | Yes | Balance assistance in person |

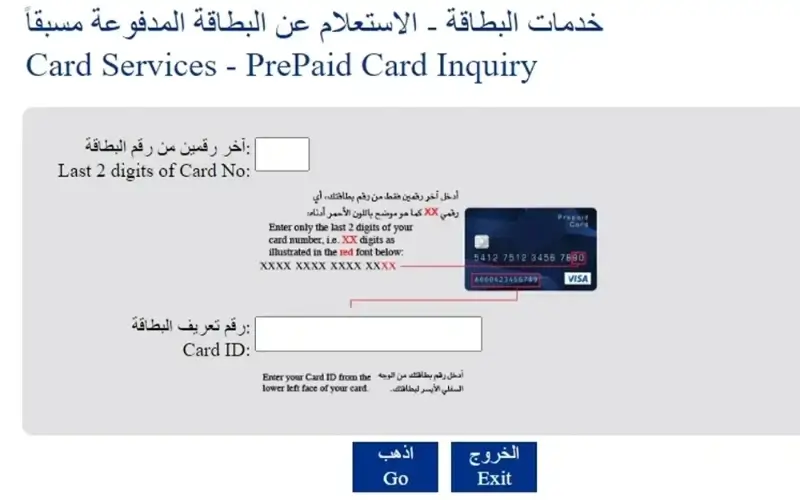

NBAD Prepaid Card Inquiry Explained

An inquiry from a prepaid card is a reference to the details of a checking account like the balance that is available or recent salary credit or confirmation of transaction. The majority of these inquiries are done prior to cash withdrawals or large purchases.

The purpose of prepaid credit cards is to show only the balance that is available because overdrafts aren’t allowed. This makes checking the balance crucial to prevent declines in transactions.

Using ATMs for Balance Checks

ATMs are among the most frequently used ways to check balances on prepaid cards. Cardholders are able to insert their card, type in the PIN, then choose Balance inquiry.

Balance checks at ATMs are easy and easy to PPC NBAD Balance Check access, particularly for employees who don’t frequently use online banking. Many cardholders prefer this option due to its simplicity and accessibility throughout the UAE.

Salary Credits and Balance Updates

Salary amounts are typically transferred to prepay PPC NBAD Balance Check cards in accordance with the payment schedules of the employer. When the money is credited the balance will be updated automatically and is visible during balance checks.

Cardholders are advised to verify balances on pay dates to ensure the payment was successful. This can help identify discrepancies or delays early and permits prompt follow-up with employers should they require.

Common Uses of NBAD Prepaid Cards

NBAD Prepaid cards were designed for everyday use. They permit employees to control their funds in a secure manner without having to maintain an account in a bank that is full.

The most common uses are ATM cash-draws purchases in stores, and bill payment at a variety of outlets. Regular checks of balances assure the smooth use of the transactions.

Security and PIN Protection

Security is an essential aspect of using prepaid cards. Cardholders should secure their PINs and refrain from sharing details about their card. Balance inquiries should be done via official and secure channels.

If a credit card is stolen or stolen, prompt reporting assists in preventing unauthorized use. Balance checks can help identify suspicious activity earlier.

Customer Support for Balance Queries

NBAD provides support to customers to help cardholders who have balance-related queries. Support teams can verify the balance, explain transactions, and provide guidance regarding the usage of their cards.

Customer service can be particularly useful for those who are facing ATM problems or technical issues in making checks on balances.

PPC NBAD Balance Check for Employers

Employers also gain by having employees learn the process of checking balances. This reduces the need for payroll queries and enhances the transparency of pay distribution.

Communication about pay date along with balance request options help keep payroll operations running smoothly.

Digital Banking and Card Access

Digital banking continues to grow across the UAE. While access to prepaid cards might be restricted compared to bank accounts that are full, NBAD continues to enhance the cardholder’s digital experience.

Online access, when it is available, makes it easy to check balances and transactions without having to visit branches or ATMs.

NBAD and UAE Wage Protection System

NBAD Prepaid cards are typically employed under the UAE Wage Protection System. This guarantees that salaries are paid on time with financial institutions that have been approved.

Balance checking is transparent and assists employees in ensuring the compliance of salary payment regulations.

Avoiding Common Balance Check Issues

Certain cardholders have problems like incorrect PIN entry or ATM outages. These problems are typically solved by retrying the transaction or contacting customer service.

Making sure that card information is updated and utilizing official channels lowers the likelihood of balance inquiry issues.

Financial Awareness and Budgeting

Regular check-ups on balances can help increase financial awareness. Knowing the amount of money available helps employees budget expenses, reduce costs, and avoid fees that are not needed.

Prepaid cards permit budget-controlled spending because the cardholder can only spend what is on the card.

Limitations of Prepaid Payroll Cards

While prepaid cards can be convenient however, they are not as secure to fully-fledged bank accounts. They can have the limitations of online capabilities and restrictions on use in international locations.

Knowing these limitations can help cardholders use their cards efficiently and reduces expectations.

Importance of PPC NBAD Balance Check

A regular check of the balance on a Ppc card assists cardholders in staying informed about declined transactions and verifying the payment of salary. It is a crucial element in the daily management of finances for those who use prepaid cards.

Balance awareness can also build the trust between employees, employers as well as banks.

Conclusion

NBAD Payroll cards that are prepaid provide an efficient and secure method employees can receive and manage salary throughout the UAE. Knowing the options for balance inquiry and making use of them frequently ensures seamless transactions and greater financial control. Through ATMs, customer service, or through digital channels, confirming balances is a must for each card holder. If they are aware and active, consumers can get the most value from their prepaid card while being common issues. This comprehensive guide to the ppc bad balance check will help employees and employers alike to understand the process of checking balances clearly and with confidence.

FAQS

How do I find my NBAD balance on my prepaid card?

Check your account balance with ATMs, customer support or any other available digital services.

Are there any fees to inquire about balances?

Certain AM balance checks could have minor fees based on the network being used.

Do I have the ability to check my balance without going to the branch?

Yes ATMs and support services permit balance checks with no branch visits.

What do I do if my balance isn’t correct?

Reach out to NBAD customer support, or your employer immediately to get clarification.

Are NBAD prepay cards tied to accounts at banks?

These aren’t, they’re stored-value cards, not bank accounts.